HUX BLOG

LATEST ARTICLES

9.9.24 Weekly Market Commentary

Week In Review

In a holiday-shortened week, market participants could feel the tension in the air as multiple Federal Reserve governors seemingly turned the page on inflation concerns and now appeared to be squarely focused on the challenge of sustaining economic growth. The financial markets perused the release of several economic indicators but found little evidence to help mitigate the sense of trepidation. The ISM Manufacturing Index was dismal, as twelve of the eighteen major manufacturing industries reported contraction in August. 3 The ISM Services Index managed to counter the bleak production data, but the tenth of a point gain was benign for sentiment. The Fed Beige Book for August added to slowdown fears as the number of districts with flat or declining activity rose from five in the prior period to nine in the current period. 4 The nonfarm payrolls report was also mixed, with job gains less than expected but a modest decline in the unemployment rate. In anticipation of interest rate cuts beginning this month, the relationship between the 2-year and the 10-year Treasury yield normalized after being inverted since June 2022. Sector rotation picked up steam in the equity markets as volatile information technology stocks sold off in favor of more defensive consumer staples and real estate categories. In a classic flight to safety, the S&P 500 dipped -4.3%.

This Week

While Fed Chairman Jerome Powell may assert that the central bank is attentive to the mandate of

maximum sustainable employment, the release of the Consumer Price Index on Wednesday will receive its due consideration prior to the Fed policy decision on the 18th of this month.

Portfolio Themes

Since 2002, an average of 33 of the top 50 performing companies each year are international. Consequently, having a “home bias” can be costly. Simplicity offers a curated roster of third-party managers that provide exposure to international markets that may boost long-term performance.

_________________________________________________________________________________

Data: Unless otherwise noted, data for charts, graphs, and tables is sourced from YCharts. Portfolio Themes chart sourced from J.P. Morgan Asset Management.

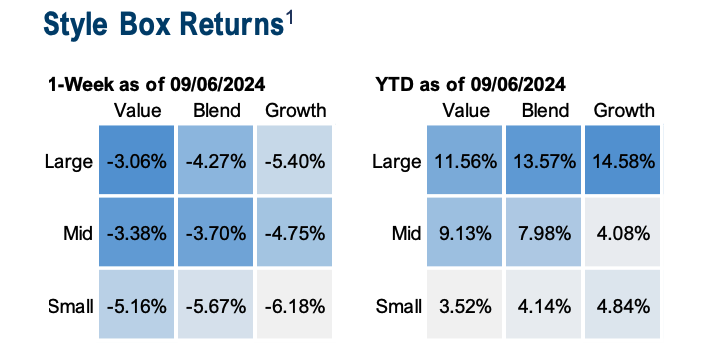

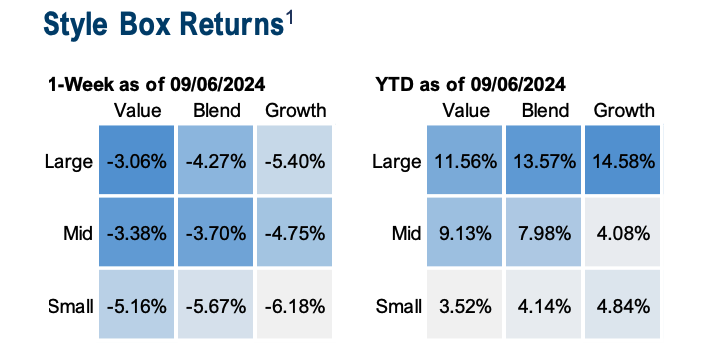

1 Style box returns use various Russell indices tied to specific areas of the market cap (vertical) and style (horizontal) spectrums.

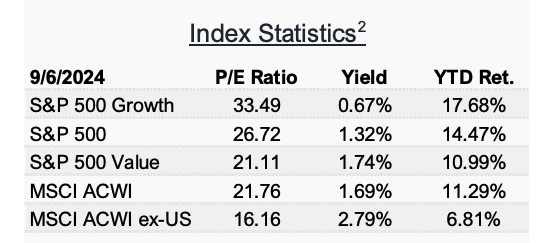

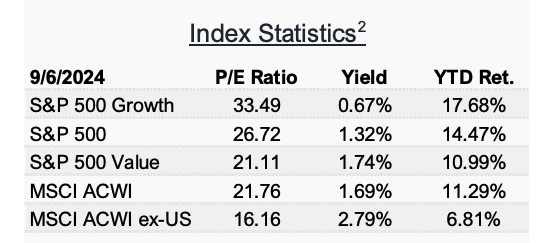

2 Index Statistics: P/E TTM – Calculated by dividing an investment’s price by the trailing 12-month earnings per share value. Yield – Expected dividend-per-share divided by current share price. Table statistics are updated monthly. MSCI indices represent broad global and international equity markets. Indices are represented by iShares ETF proxies (IVW, IVV, IVE, ACWI, and ACWX). Past performance does not guarantee future results.

3 First Trust Advisors.

4 federalreserve.gov/monetarypolicy/beigebook. Weekly commentary and investment advisory services are provided by Simplicity Wealth, LLC a SEC Registered Investment Adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and does not constitute any form of advice or recommendation. The information contained within has been obtained from various sources and is believed to be accurate at the time of publication .

HUX BLOG

LATEST ARTICLES

9.9.24 Weekly Market Commentary

Week In Review

In a holiday-shortened week, market participants could feel the tension in the air as multiple Federal Reserve governors seemingly turned the page on inflation concerns and now appeared to be squarely focused on the challenge of sustaining economic growth. The financial markets perused the release of several economic indicators but found little evidence to help mitigate the sense of trepidation. The ISM Manufacturing Index was dismal, as twelve of the eighteen major manufacturing industries reported contraction in August. 3 The ISM Services Index managed to counter the bleak production data, but the tenth of a point gain was benign for sentiment. The Fed Beige Book for August added to slowdown fears as the number of districts with flat or declining activity rose from five in the prior period to nine in the current period. 4 The nonfarm payrolls report was also mixed, with job gains less than expected but a modest decline in the unemployment rate. In anticipation of interest rate cuts beginning this month, the relationship between the 2-year and the 10-year Treasury yield normalized after being inverted since June 2022. Sector rotation picked up steam in the equity markets as volatile information technology stocks sold off in favor of more defensive consumer staples and real estate categories. In a classic flight to safety, the S&P 500 dipped -4.3%.

This Week

While Fed Chairman Jerome Powell may assert that the central bank is attentive to the mandate of

maximum sustainable employment, the release of the Consumer Price Index on Wednesday will receive its due consideration prior to the Fed policy decision on the 18th of this month.

Portfolio Themes

Since 2002, an average of 33 of the top 50 performing companies each year are international. Consequently, having a “home bias” can be costly. Simplicity offers a curated roster of third-party managers that provide exposure to international markets that may boost long-term performance.

_________________________________________________________________________________

Data: Unless otherwise noted, data for charts, graphs, and tables is sourced from YCharts. Portfolio Themes chart sourced from J.P. Morgan Asset Management.

1 Style box returns use various Russell indices tied to specific areas of the market cap (vertical) and style (horizontal) spectrums.

2 Index Statistics: P/E TTM – Calculated by dividing an investment’s price by the trailing 12-month earnings per share value. Yield – Expected dividend-per-share divided by current share price. Table statistics are updated monthly. MSCI indices represent broad global and international equity markets. Indices are represented by iShares ETF proxies (IVW, IVV, IVE, ACWI, and ACWX). Past performance does not guarantee future results.

3 First Trust Advisors.

4 federalreserve.gov/monetarypolicy/beigebook. Weekly commentary and investment advisory services are provided by Simplicity Wealth, LLC a SEC Registered Investment Adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and does not constitute any form of advice or recommendation. The information contained within has been obtained from various sources and is believed to be accurate at the time of publication .

HUX CAPITAL MANAGEMENT

Headquarters

Located in Lafayette, Louisiana, serving clients across the country.

337.366.9892 Call or Text

800.988.7855 Call Toll Free

Please note that message and data rates from your carrier may apply. By texting us, you are giving consent for us to also contact you via text.

OUR LOCATION

Where to find us?

4023 Ambassador Caffery Pkwy

Suite 201

Lafayette, LA 70503

Investment advisory and financial planning services are offered through Simplicity Wealth, LLC, an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the firm nor does it indicate that the adviser has attained a particular level of skill or ability. Insurance, Consulting and Education services offered through Hux Capital Management is a separate and unaffiliated entity from Simplicity Wealth.

The presence of this website shall in no way be construed or interpreted as a solicitation to sell or offer to sell investment advisory services to any residents of any state other than where legally permitted. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions.

Hux Capital Management, LLC and Randy Hux are not affiliated with or endorsed by the Social Security Administration or any government agency.

Images and photographs are included for the sole purpose of visually enhancing the website. They should not be construed as an endorsement or testimonial from any of the persons in the photograph.

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs.

Copyright 2025 Hux Capital Management. All Rights Reserved.