HUX BLOG

LATEST ARTICLES

9.3.24 Weekly Market Commentary

Week In Review

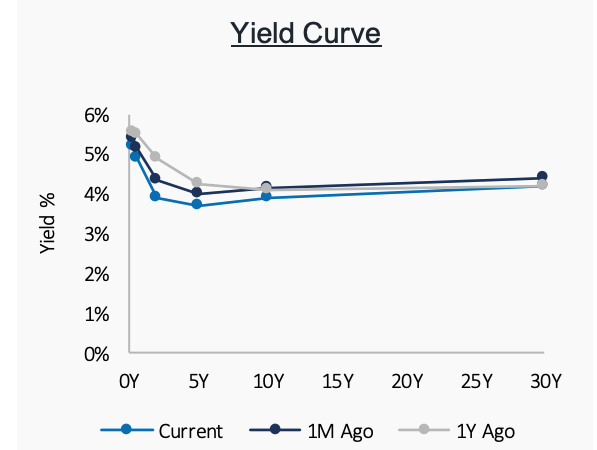

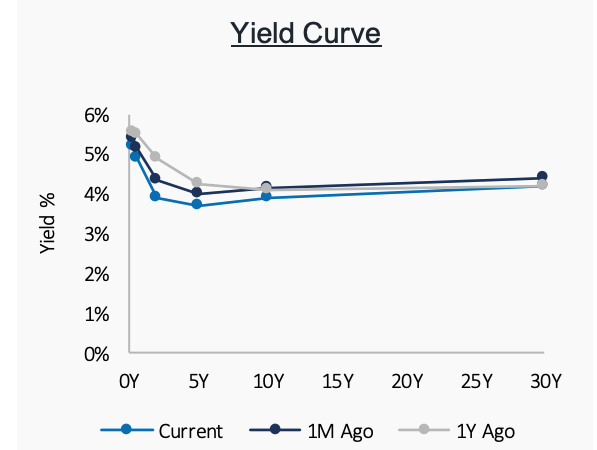

A harmonious combination of economic and technical indicators provided sustained support for recent market momentum and helped the S&P 500 close out the month of August on a positive note. The market’s perception of a resilient late-cycle expansion was fortified by a 1.3% increase in second-quarter corporate profits and an upward revision for real GDP growth to a 3.0% annual rate. 3 Headline news on inflation was also upbeat, as the Personal Consumption Expenditures Price Index met consensus estimates of 2.5% and reinforced the conviction of forthcoming interest rate reductions. While everything fell into place on the economic front, market observers were keenly focused on the latest earnings release

from market trendsetter Nvidia. The firm reported record revenues and provided strong guidance for the current quarter, but the bar had been set so high that the stock still declined. The good news - the market shook off the Nvidia downturn and the percentage of S&P 500 stocks trading above their 50-day moving average, a measure of market breadth, improved to 81.51%.4 Despite the “Black Monday 2024” meltdown on August 5th, the S&P 500 was up +2.3% for the month, a lesson in fortitude.

This Week

Fed Chairman Jerome Powell recently stated, “We are attentive to the risks to both sides of our dual mandate.” Given the market turmoil following the last employment update, the nonfarm payrolls report will have more significance for market sentiment in a holiday-shortened week.

Portfolio Themes

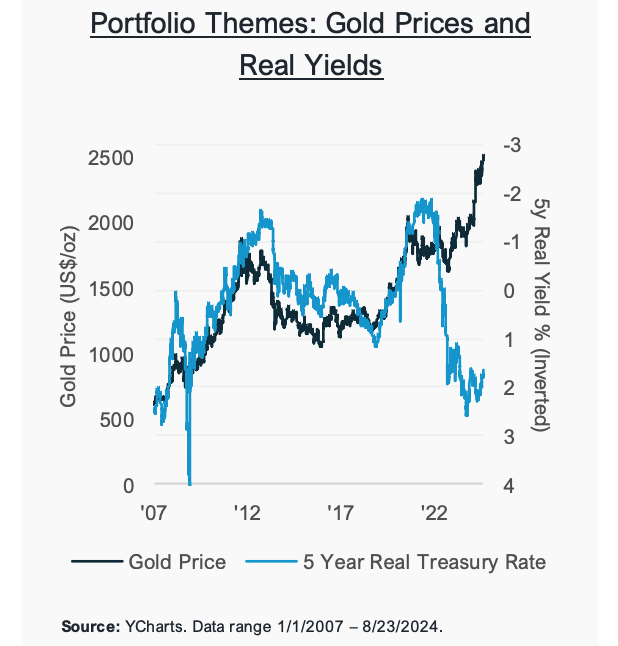

Historically, the price of gold has had an inverse relationship with real yields. As interest rates rose, demand for bonds increased and gold sold off. Yet, that relationship has broken down recently. Market pundits speculate that the disconnect is due to debt concerns, geopolitical risk, and central bank buying. Simplicity offers model portfolios with exposure to gold that may improve diversification and enhance risk management.

_________________________________________________________________________________

Data: Unless otherwise noted, data for charts, graphs, and tables is sourced from YCharts. Portfolio Themes chart sourced from State Street Global Advisors.

1Style box returns use various Russell indices tied to specific areas of the market cap (vertical) and style (horizontal) spectrums.

2 Index Statistics: P/E TTM – Calculated by dividing an investment’s price by the trailing 12-month earnings per share value. Yield – Expected dividend-per-share divided by current share price. Table statistics are updated monthly. MSCI indices represent broad global and international equity markets. Indices are typically not available for direct investment, are unmanaged, and do not incur fees or expenses. Past performance does not guarantee future results.

3First Trust Advisors.

4barchart.com. Weekly commentary and investment advisory services are provided by Simplicity Wealth, LLC a SEC Registered Investment Adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and does not constitute any form of advice or recommendation. The information contained within has been obtained from various sources and is believed to be accurate at the time of publication.

HUX BLOG

LATEST ARTICLES

9.3.24 Weekly Market Commentary

Week In Review

A harmonious combination of economic and technical indicators provided sustained support for recent market momentum and helped the S&P 500 close out the month of August on a positive note. The market’s perception of a resilient late-cycle expansion was fortified by a 1.3% increase in second-quarter corporate profits and an upward revision for real GDP growth to a 3.0% annual rate. 3 Headline news on inflation was also upbeat, as the Personal Consumption Expenditures Price Index met consensus estimates of 2.5% and reinforced the conviction of forthcoming interest rate reductions. While everything fell into place on the economic front, market observers were keenly focused on the latest earnings release

from market trendsetter Nvidia. The firm reported record revenues and provided strong guidance for the current quarter, but the bar had been set so high that the stock still declined. The good news - the market shook off the Nvidia downturn and the percentage of S&P 500 stocks trading above their 50-day moving average, a measure of market breadth, improved to 81.51%.4 Despite the “Black Monday 2024” meltdown on August 5th, the S&P 500 was up +2.3% for the month, a lesson in fortitude.

This Week

Fed Chairman Jerome Powell recently stated, “We are attentive to the risks to both sides of our dual mandate.” Given the market turmoil following the last employment update, the nonfarm payrolls report will have more significance for market sentiment in a holiday-shortened week.

Portfolio Themes

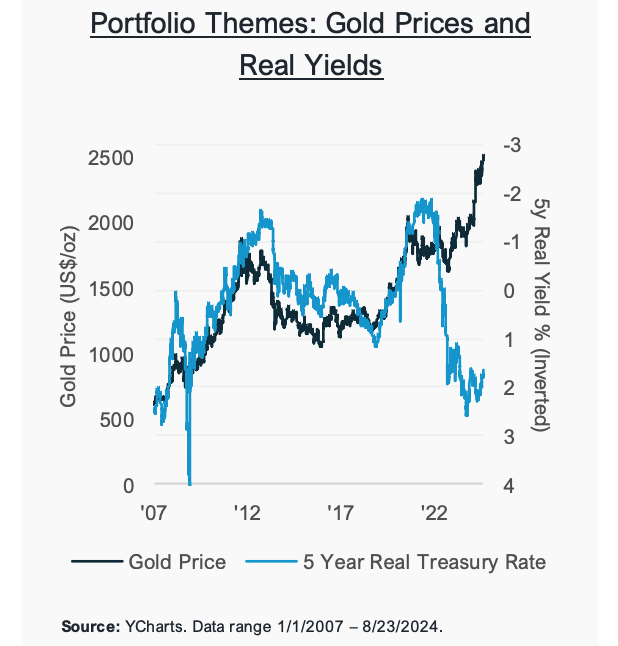

Historically, the price of gold has had an inverse relationship with real yields. As interest rates rose, demand for bonds increased and gold sold off. Yet, that relationship has broken down recently. Market pundits speculate that the disconnect is due to debt concerns, geopolitical risk, and central bank buying. Simplicity offers model portfolios with exposure to gold that may improve diversification and enhance risk management.

_________________________________________________________________________________

Data: Unless otherwise noted, data for charts, graphs, and tables is sourced from YCharts. Portfolio Themes chart sourced from State Street Global Advisors.

1Style box returns use various Russell indices tied to specific areas of the market cap (vertical) and style (horizontal) spectrums.

2 Index Statistics: P/E TTM – Calculated by dividing an investment’s price by the trailing 12-month earnings per share value. Yield – Expected dividend-per-share divided by current share price. Table statistics are updated monthly. MSCI indices represent broad global and international equity markets. Indices are typically not available for direct investment, are unmanaged, and do not incur fees or expenses. Past performance does not guarantee future results.

3First Trust Advisors.

4barchart.com. Weekly commentary and investment advisory services are provided by Simplicity Wealth, LLC a SEC Registered Investment Adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and does not constitute any form of advice or recommendation. The information contained within has been obtained from various sources and is believed to be accurate at the time of publication.

HUX CAPITAL MANAGEMENT

Headquarters

Located in Lafayette, Louisiana and primarily serving Acadiana.

337.366.9892 Call or Text

800.988.7855 Call Toll Free

Please note that message and data rates from your carrier may apply. By texting us, you are giving consent for us to also contact you via text.

OUR LOCATION

Where to find us?

4023 Ambassador Caffery Pkwy

Suite 201

Lafayette, LA 70503

Investment advisory and financial planning services are offered through Simplicity Wealth, LLC, an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the firm nor does it indicate that the adviser has attained a particular level of skill or ability. Insurance, Consulting and Education services offered through Hux Capital Management is a separate and unaffiliated entity from Simplicity Wealth.

The presence of this website shall in no way be construed or interpreted as a solicitation to sell or offer to sell investment advisory services to any residents of any state other than where legally permitted. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions.

Hux Capital Management, LLC and Randy Hux are not affiliated with or endorsed by the Social Security Administration or any government agency.

Images and photographs are included for the sole purpose of visually enhancing the website. They should not be construed as an endorsement or testimonial from any of the persons in the photograph.

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs.

Copyright 2023 Hux Capital Management. All Rights Reserved.

Copyright 2023 Hux Capital Management.

All Rights Reserved.