8.5.24 Weekly Market Commentary

Monday, August 5, 2024

This week's insights from Simplicity Wealth's

Thomas Rozman, CFA, CAIA | Partner & Chief Investment Officer

Matthew Opsal | Senior Manager Research Analyst

Week In Review

Economic data can sometimes be an enigma to the financial markets. Depending on the context of a report and other contributing factors, the same headline can support either positive or negative market sentiment. Unfortunately, there was no such mystery to be divined last week, as bad news was simply bad news. The opening salvo was the release of the ISM manufacturing survey that showed the lowest level of activity since last November. That bulletin was followed by a daunting employment update. Payroll gains were much weaker than expected and the unemployment rate rose to its highest level since 2021. 3 That backdrop and subsequent earnings disappointments by bellwether firms were tinder for high relative equity valuations and fueled adverse equity momentum that not even an optimistic post-meeting Federal Reserve policy statement could stave off. Bond yields declined across the curve, with the 10-year U.S. Treasury yield hitting a low of 3.72%. 4 Stock indices all succumbed to recession fears and the S&P 500 declined -2.1%, its worst performance since 2022. 5

This Week

The financial markets will have a relatively pedestrian week for economic data. The companion to last week’s manufacturing survey, the ISM services report, will be released on Monday. The earnings parade continues with Caterpillar and Owens Corning providing insight into the strength of construction, infrastructure, and home building expenditures.

Portfolio Themes

Changes in the macroeconomic regime often foreshadow the greatest risk to sector valuations and equity momentum. Currently, the sector with the best combination of momentum and valuation factors would be communication services, followed by utilities, real estate, and energy. Simplicity provides access to a curated roster of third-party managers that explicitly utilize business cycle changes to determine suitable market sector allocations, capture risk premiums and reduce model portfolio risk.

_________________________________________

Data: Unless otherwise noted, data for charts, graphs, and tables is sourced from Morningstar Direct. Portfolio Themes chart sourced from Columbia Threadneedle. 1Style box returns use various Russell indices tied to specific areas of the market cap (vertical) and style (horizontal) spectrums.

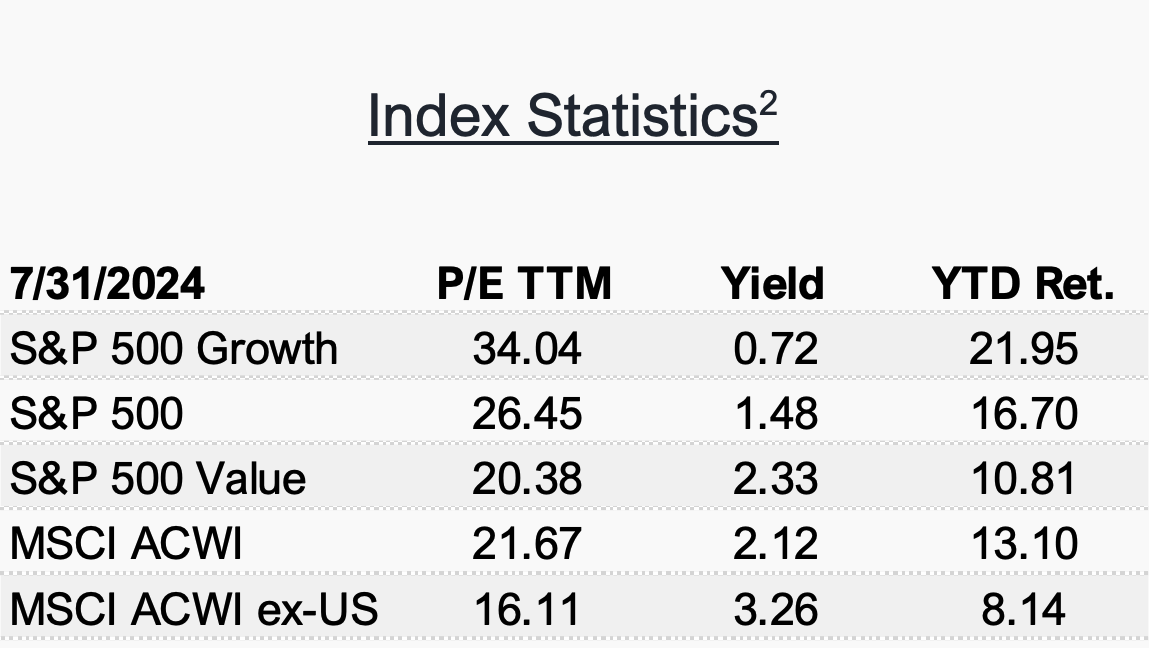

2 Index Statistics: P/E TTM – Calculated by dividing an investment’s price by the trailing 12-month earnings per share value. Yield – Expected dividend-per-share divided by current share price. Table statistics are updated monthly. MSCI indices represent broad global and international equity markets. Indices are typically not available for direct investment, are unmanaged, and do not incur fees or expenses. Past performance does not guarantee future results.

3 CNBC.

4 YCharts.

5 www.marketwatch.com. Weekly commentary and investment advisory services are provided by Simplicity Wealth, LLC a SEC Registered Investment Adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and does not constitute any form of advice or recommendation. The information contained within has been obtained from various sources and is believed to be accurate at the time of publication