Nobody Wants Your Stuff

Nobody Wants Your Stuff

And Why That’s Actually a Gift

Estate Planning Tips: Protecting Your Family & Your Legacy

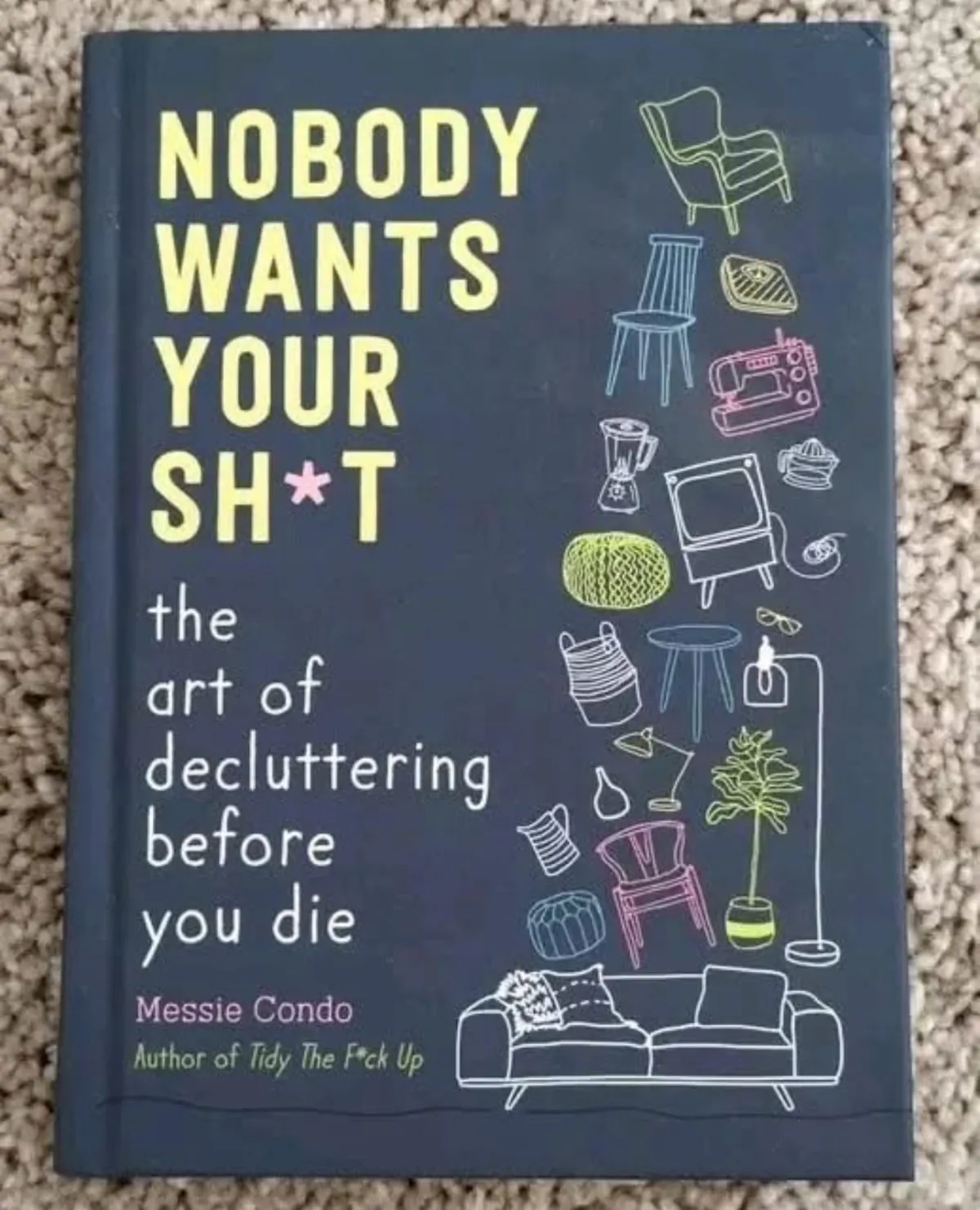

I recently came across a book with a title that stopped me in my tracks: Nobody Wants Your Sht.*

Yes, that’s the real title. It’s funny, a little bit rude, and surprisingly poignant. What started as a late-night scroll turned into a full-on reckoning—not just with clutter, but with the emotional weight we unknowingly pass on to our families when we don’t plan.

As someone who works with families on legacy planning, this hit close to home. Because here’s the truth: the stuff we accumulate often says more about us than we realize. And yet, the best gift we can leave behind often isn’t found in a box—it’s found in clarity.

1. The Hidden Burden of “Stuff”

You might think you’re doing your family a favor by saving heirlooms, paperwork, or “just in case” collections. But often, what you’re really leaving is a massive to-do list disguised as sentiment.

When we talk about estate planning, most people immediately think of wills or legal documents. And yes, those are crucial. But emotional clutter counts, too. Physical items carry stories, yes—but if they aren’t organized or explained, they can also create stress, guilt, and confusion.

2. Decluttering Is an Act of Love

Let’s be honest: no one wants to sort through 42 boxes of mystery paperwork or make tough decisions about items they don’t understand or recognize.

Decluttering now, while you’re healthy and clear-headed, is one of the most considerate things you can do for your loved ones. You’re not just tidying up—you’re making sure that your family has the time and space to focus on grieving, remembering, and healing when that day comes.

3. What Does This Have to Do with Financial Planning?

Everything.

As part of our planning conversations, we review financial accounts and estate documents while encouraging clients to also consider the personal side of their legacy. We help you organize your investments, retirement accounts, and estate plans. But we also encourage you to think about what you’re really leaving behind.

Legacy planning isn’t just about who gets what. It’s about who must deal with what—and how prepared they feel to do it.

4. So Where Do You Start?

Start small. Pick one drawer, one box, one file cabinet.

Make decisions while you can explain them. Your stories are just as valuable as the items themselves.

Organize financial and legal documents. Make sure your paperwork makes sense and is easy to access.

Communicate your wishes. Don’t leave your loved ones guessing. A good plan is one everyone understands.

Final Thought:

Nobody wants your stuff… and that’s a beautiful opportunity. Because what they do want is a legacy of clarity, care, and intention.

Let’s work together to develop a plan designed to provide clarity now and help your family better understand your wishes in the future.

Randy Hux

Hux Capital Management – Helping clients understand their options, plan for the future, and make informed decisions.

Find out more about our services huxcapitalmanagement.com

Book a discovery call with our team https://t2m.io/DiscoveryCall